giovedì 24 marzo 2011

mercoledì 9 febbraio 2011

venerdì 7 gennaio 2011

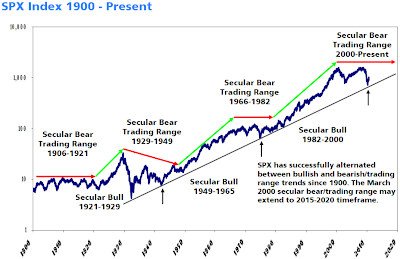

SPX Index 1900 - Presnt

giovedì 30 dicembre 2010

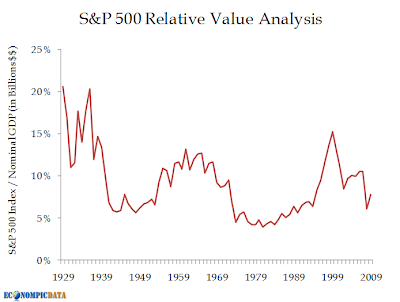

The S&P 500′s Price/Earnings Ratio

The two lines are scaled at a ratio of 16 to 1 which means that when the lines cross, the P/E Ratio is exactly 16.

The two lines are scaled at a ratio of 16 to 1 which means that when the lines cross, the P/E Ratio is exactly 16.da CrossingWallStreet.com di Eddy

lunedì 27 dicembre 2010

mercoledì 22 dicembre 2010

lunedì 17 maggio 2010

mercoledì 5 maggio 2010

The World’s Simplest Portfolio

Scott Adams of Dilbert fame gives us his suggestion for the World’s Simplest Portfolio (“that is better than what the average money managing expert might concoct”).

He suggests half in the Vanguard Total Stock Market ETF (VTI) and half in the Vanguard Emerging Market ETF (VWO).

That’s not bad, but I can make it even simpler—put all of your money is a Treasury set for the date you need the money. Simple, right? Even better, use a zero-coupon Treasury which is like automatically reinvesting your dividends.

You can skip the transaction costs by buying the bond right from the Treasury. Your default risk is nil.

There’s a chance that you might not perform as well as the market as a whole, but over the past few decades, the equity premium hasn’t been much to write home about. Plus, most of the premium would be eaten away by expenses, even tiny ones from Vanguard.

If you were to design a ratio of Performance-to-Headaches, this portfolio is hard to beat.

This chart above shows how the two ETFs Adams recommends have performed, plus the American Century Target 2025 fund which I'm including as a proxy for long-term Treasuries.

Posted by edelfenbein CrossingWallStreetat.com May 4, 2010 12:39 PM

He suggests half in the Vanguard Total Stock Market ETF (VTI) and half in the Vanguard Emerging Market ETF (VWO).

That’s not bad, but I can make it even simpler—put all of your money is a Treasury set for the date you need the money. Simple, right? Even better, use a zero-coupon Treasury which is like automatically reinvesting your dividends.

You can skip the transaction costs by buying the bond right from the Treasury. Your default risk is nil.

There’s a chance that you might not perform as well as the market as a whole, but over the past few decades, the equity premium hasn’t been much to write home about. Plus, most of the premium would be eaten away by expenses, even tiny ones from Vanguard.

If you were to design a ratio of Performance-to-Headaches, this portfolio is hard to beat.

This chart above shows how the two ETFs Adams recommends have performed, plus the American Century Target 2025 fund which I'm including as a proxy for long-term Treasuries.

Posted by edelfenbein CrossingWallStreetat.com May 4, 2010 12:39 PM

lunedì 26 aprile 2010

sabato 28 novembre 2009

giovedì 12 novembre 2009

mercoledì 4 novembre 2009

martedì 27 ottobre 2009

venerdì 23 ottobre 2009

giovedì 8 ottobre 2009

giovedì 1 ottobre 2009

sabato 12 settembre 2009

sabato 15 agosto 2009

mercoledì 8 luglio 2009

Iscriviti a:

Post (Atom)